What was the challenge?

When a large investment fund was placed into receivership, the appointed restructuring firm needed to determine the fair market value of the fund’s remaining investment assets. The portfolio included several exotic structured notes, complex hybrid securities that are not publicly traded and have no observable market prices. Frontier Economics was engaged to independently value these assets as part of the receivership process.

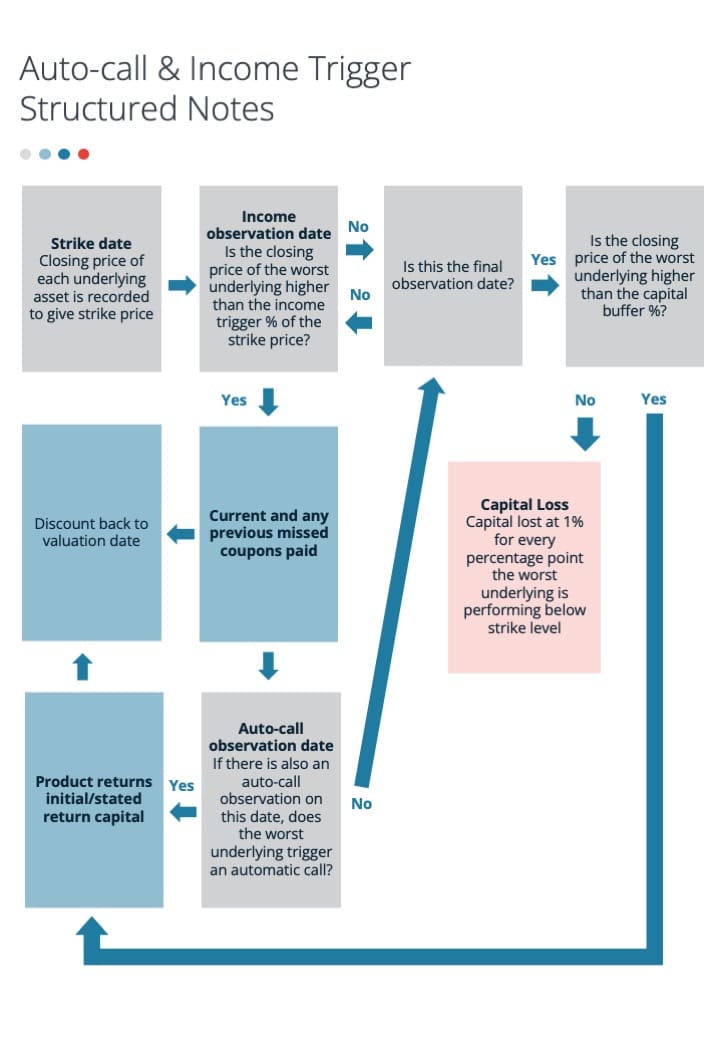

The securities to be valued were variants of ‘auto-call structured notes.’ While each note has its own particular terms, they share a number of common features.

- Each note generates a payoff that depends on the evolution of one or more underlying indexes (or sometimes individual stocks).

- Each note has a specific life with a set number of ‘observation dates.’ If all underlying indexes are above their starting levels on that date the note is auto-called and the owner receives a specified payment, and the note terminates.

- The amount of the auto-call payment varies across notes. Most commonly, the amount is set equal to the initial investment plus an additional amount that depends on the time elapsed since the note was issued.

If the note reaches the end of its specified life without being auto-called, there are generally two possibilities. Both possibilities depend on the level of the worst-performing underlying index at the end of the note’s specified life:

- If the worst -performing index is above the ‘capital protection level’, the note pays out 100% of the initial investment; and

- If the worst-performing index is below the capital protection level, the note pays out that proportion of the initial investment.