Frontier Economics' Stephen Gray was commissioned by Vector to assess whether the draft Input Methodology decision by the New Zealand Commerce Commission will help or hinder the investment that’s needed to decarbonise the economy. The New Zealand Commerce Commission is currently developing a final decision over the key regulatory principles that bind the way electricity networks in Aotearoa New Zealand can operate and invest for the next seven years, and possibly longer (the Input Methodologies, or IMs).

In this video below, Stephen shares his view on how the IMs could support the network investments needed to deliver New Zealand’s energy transition to net zero by 2050.

Electrification is at the core of New Zealand’s decarbonisation strategy, and this will require extensive investment in transmission and distribution networks over a short period of time. Indeed, it will be impossible for New Zealand to meet its decarbonisation commitments without this extensive network investment.

Moreover, there is widespread agreement that investment in electricity networks today will secure long-term benefits for consumers. So it is important that New Zealand’s regulatory framework helps to facilitate the network investment that is required. However, there is a real risk that the current regulatory framework will, in fact, hinder major network investment projects.

The key problem is that the regulatory cash flows tend to be back-ended, creating a risk that the cash flows in the early years of a project’s life are not sufficient to support the credit rating and gearing that the regulator has assumed. Where this happens, a project is not commercially viable and does not proceed. And, of course, no consumers receive any benefit from a project that does not proceed.

Our analysis found the draft Input Methodologies do not contain the sort of ‘financeability’ test that regulators in other markets employ. Nor do they provide potential investors with certainty about how a financeability issue would be addressed if it was identified.

A process to ensure that the regulatory cash flows are sufficient to support the credit rating and gearing that the regulator has assumed would remove a regulatory roadblock to the efficient investment that’s needed to meet the task of decarbonisation.

Extra for experts – a solution

A workable solution could be for the Input Methodologies to accelerate the allowed cash flows in a Net Present Value-neutral manner, as Stephen explains in this short video. The draft Input Methodologies decision canvassed several options to make this happen, of which the most promising was removing indexation of the Regulated Asset Base.

This excerpt was originally published in Vector's stakeholder newsletter.

Frontier Economics' recently advised a number of clients in relation to the Queensland Competition Authority's review of its approach to climate change related expenditure. Below are some highlights and commentary on our advice included in the final position paper.

The Queensland Competition Authority (QCA) has released its final position paper for the Climate Change Expenditure Review 2023, referencing our independent advice to Dalrymple Bay Infrastructure (DBI) and Aurizon Network.

The QCA initiated this review to:

- ensure its framework for assessing the prudency and efficiency of climate change related expenditure is fit-for-purpose and capable of incentivising timely investment when such expenditure would promote the long-term interests of consumers; and

- provide greater clarity and certainty to stakeholders—including consumers and regulated businesses—on how the QCA intends to assess future proposals related to climate adaptation and mitigation expenditure.

Economic regulators need to perform a difficult balancing act when assessing expenditure proposals related to managing climate change risks. The impact of climate change on regulated infrastructure (and, therefore, on users of that infrastructure) is fraught with uncertainty.

- If regulators set a low threshold for the prudency of climate change related expenditure, then consumers may pay more than the efficient amount required to manage climate change risks effectively.

- Conversely, if regulators are too conservative in their assessment of climate change related expenditure, that may imperil the reliability and safety of the infrastructure used to deliver regulated services. This, in turn, may expose consumers to significant economic losses.

Uncertainty over whether regulators will approve climate change related expenditure—or over whether recovery of such expenditure would be disallowed once it has been incurred—may deter regulated businesses from making prudent and efficient investments to improve the resilience of their networks.

Clear guidance about how proposals for climate change related expenditure will be assessed by regulators can help reduce this uncertainty and encourage prudent and efficient investments that may otherwise be foregone.

For this reason, other economic regulators, should conduct their own reviews and publish formal guidelines on how they intend to assess regulatory proposals for climate change related expenditure. The QCA’s guidelines are not specific to any particular industry or jurisdiction, so would be a relevant starting point for other regulators and regulated businesses beyond Queensland.

Managing climate uncertainty to invest prudently and efficiently in resilience

Of the many issues covered by the QCA’s review, our advice focussed on the development of a framework to assess the prudency and efficiency of climate change adaptation expenditure.

Below are some highlights:

We advised Aurizon Network that:

“In assessing prudent and efficient ex ante resilience expenditure the QCA should encourage regulated entities to pragmatically incorporate the uncertainty inherent in climate change related risks into their proposals for adaptation expenditure.”

In our report to DBI, we added:

“Climate-resilience should be a necessary condition to project prudency and efficiency. Investing in infrastructure that is vulnerable, by design, to an accepted range of climate-related risks is likely to be lower cost in the short term but higher cost in total over the life of the asset.”

We discussed the development of an upfront expenditure framework that could facilitate investment under uncertainty, providing advantages to both regulated infrastructure providers and their customers. That is, a framework which:

- is ex-ante in nature;

- relies on the justification for the proposed expenditure;

- includes in its ex-post review mechanisms a consideration of uncertainties related to climate-related risk; and

- is proactive in managing long-term demand uncertainty.

We considered that these elements together would promote regulatory certainty and facilitate investment in prudent and efficient levels of infrastructure resilience.

The Coal Effect – funding and financing approaches to address residual stranding risk

Fossil fuel exposed firms are exposed to transition risk, or risks arising from the process of adjusting towards a lower-carbon economy. This can impact forecasted demand, the value of assets and liabilities, and thereby the risk profile and viability of the regulated business.

A key driver of transition risk for coal exposed companies is policy change. Net zero targets, can reduce domestic demand for coal. However, targets vary in status, development and expected achievement date. This uncertainty, in combination with uncertainty around technological development and carbon abatement costs, makes future demand for coal similarly unclear.

We identified a scenario where Aurizon Network may support more adaptation expenditure to increase the resilience of the network (with the expenditure to go into the regulatory asset base). However, future customers may be unwilling or unable to continue to pay for past adaptation expenditure. These factors create asset stranding risk, which may disincentivise a regulated business from investing in network resilience today, even if the investments are supported by current customers.

We then considered options the QCA might adopt to address asset stranding risk. We discussed the merits of addressing an increased stranding risk associated with climate change via an uplift to the allowed rate of return (i.e., the ‘fair bet’ approach) that would be just sufficient to compensate investors for the increase in stranding risk.

Also considered was the use of accelerated depreciation, which has been used by regulators in Western Australia (ERAWA) and New Zealand (the Commerce Commission) to address the stranding risks faced by gas pipelines following the adoption of emissions targets that have shortened the expected economic life of those regulated assets.

In our advice, we recommended that the QCA should confirm clearly that:

- its regulatory framework will continue to provide regulated businesses with a realistic opportunity to recover past prudent and efficient expenditure over the long term;

- regulatory allowances will be set such that climate change related expenditure that is deemed to be prudent and efficient, based on information available at the time, may be recovered over the expected economic life of the assets; and

- the expected economic life of the assets should be reassessed periodically as new information becomes available.

Overall, we identified the benefits in the QCA providing clear upfront guidance on the types of information and evidence it would require from regulated businesses, to demonstrate asset stranding risks and management responses.

This could include the QCA needing to take into consideration a larger range of plausible future scenarios, rather than focusing on just the expected future profile of demand at a given point in time, reflecting the long-term uncertainty faced by the coal industry.

Frontier Economics Pty Ltd is a member of the Frontier Economics network, and is headquartered in Australia with a subsidiary company, Frontier Economics Pte Ltd in Singapore. Our fellow network member, Frontier Economics Ltd, is headquartered in the United Kingdom. The companies are independently owned, and legal commitments entered into by any one company do not impose any obligations on other companies in the network. All views expressed in this document are the views of Frontier Economics Pty Ltd.

DOWNLOAD FULL PUBLICATION

The economics of water security in Australia’s hydrogen transition

Hydrogen gas has been hailed as the next big clean energy source, and Australia, with its abundance of renewable energy potential, is seen as well positioned to lead the charge to net zero. Governments and utilities are increasingly turning their focus to how the potentially large but uncertain water requirements to support Australia’s hydrogen transition can be met.

The quantity and variability of Australia’s water resources compared with other continents is well known, as are the expected reductions in average groundwater and surface water supplies available for consumption. The challenge for Governments and utilities is how to plan for and deliver water services to meet growth in underlying demand as well as potentially large but uncertain growth in industrial water demand – including to support Australia’s hydrogen transition.

In this context, it is critical that a sound economic framework is utilised to evaluate supply and demand side measures to meet potential growth in water demand, and provide efficient price signals to water users relating to the economic, social and environmental cost of water supply. This bulletin explores how integrating the economics of water security early in the hydrogen planning process can support informed decisions about how this transition occurs, including the location of hydrogen assets and their water sources, and ensure investment in water supply occurs when and where it maximises value to the community.

Australia’s hydrogen transition could have significant water requirements

Demand for ‘clean’ or ‘green’ hydrogen is expected to dramatically increase over the next decade as it replaces other hydrocarbon-based energy sources, such as liquid fuels for vehicles and natural gas for electricity generation and heating. Australia appears well placed to take advantage of increasing global momentum for clean hydrogen with big ambitions to grow our domestic hydrogen sector, with the “aim to position our industry as a major global player by 2030.”[1] Significant resourcing including state and private funding is being committed to support this ambition.

Year-round access to a secure source of water is critical for the delivery of Australia’s hydrogen transition. The National Hydrogen Strategy notes that water required for a large-scale hydrogen production industry will be significant. Given uncertainty around the future growth of Australia’s hydrogen sector, estimates of future water demand vary, ranging from just under the current annual supply for the whole of Southeast Queensland,[2] to around one-third of the water currently used by the Australian mining industry.[3] While the water demand is uncertain, in either scenario, it is potentially significant.

The National Hydrogen Strategy acknowledges that “Australians will want the new jobs and growth of clean hydrogen to be achieved without compromising safety, cost of living, water availability, access to land or environmental sustainability”.[4]

It notes that Australia will therefore need to consider how to balance hydrogen’s demands with other water priorities.[5] Some of which “may have higher economic, social or cultural value.” [6]

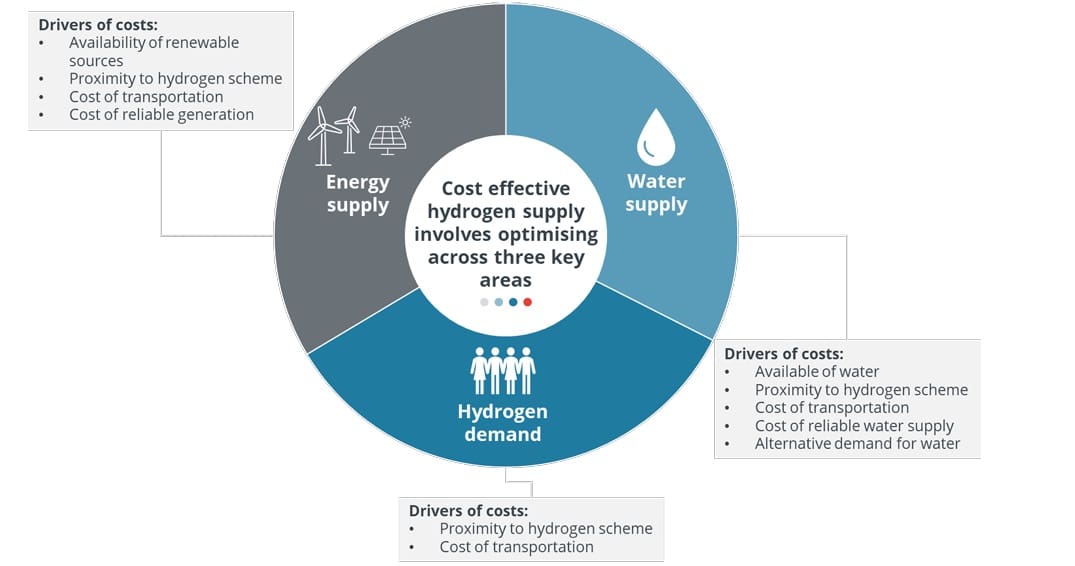

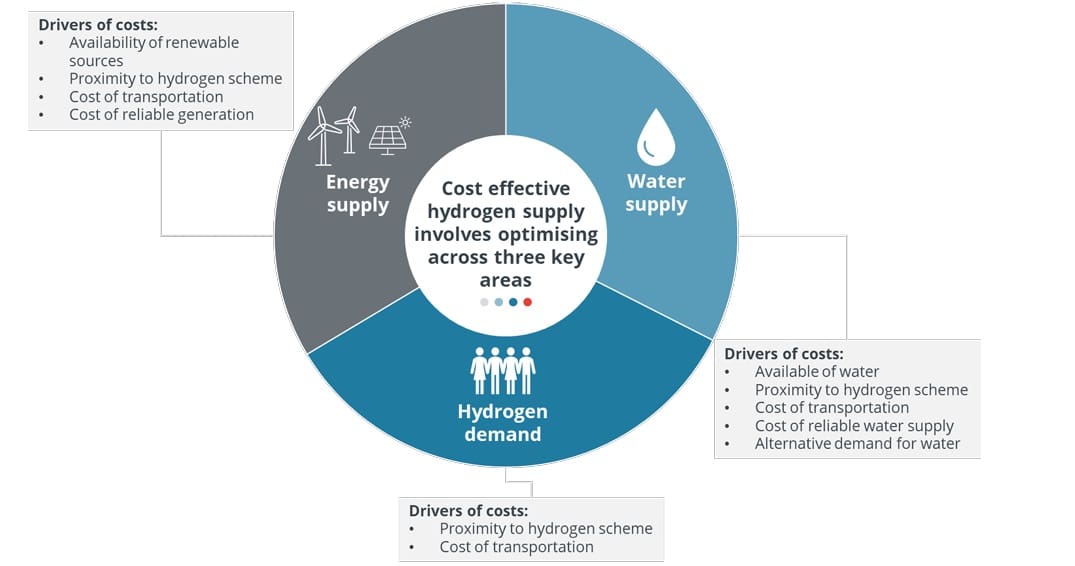

Delivering cost-effective hydrogen is likely to be a complex optimisation problem

The National Hydrogen Strategy states that “the most ideal sites for production facilities will have access to renewable electricity and water supplies”. [7]

Implicit within this is that there is a complex optimisation across numerous input and output/product markets – whether to transport energy, water and/or hydrogen.

For example, the Hunter Valley Hydrogen Hub on Koorangang Island was chosen as the location for a hydrogen hub based on its “proximity to high energy users, existing skilled workforce, existing energy infrastructure and land available for complementary businesses.”[8]

The Water Services Association of Australia states that: “For hydrogen production, 11% of Australia is suitable when considering energy needs only. This is reduced to only 3% when factoring water and transport infrastructure”.[9]

A key element when considering the cost of water in this optimisation is:

- The financial cost of water supply which is driven by water availability and at what price;

- Broader social, economic and cultural costs of accessing or transporting water;

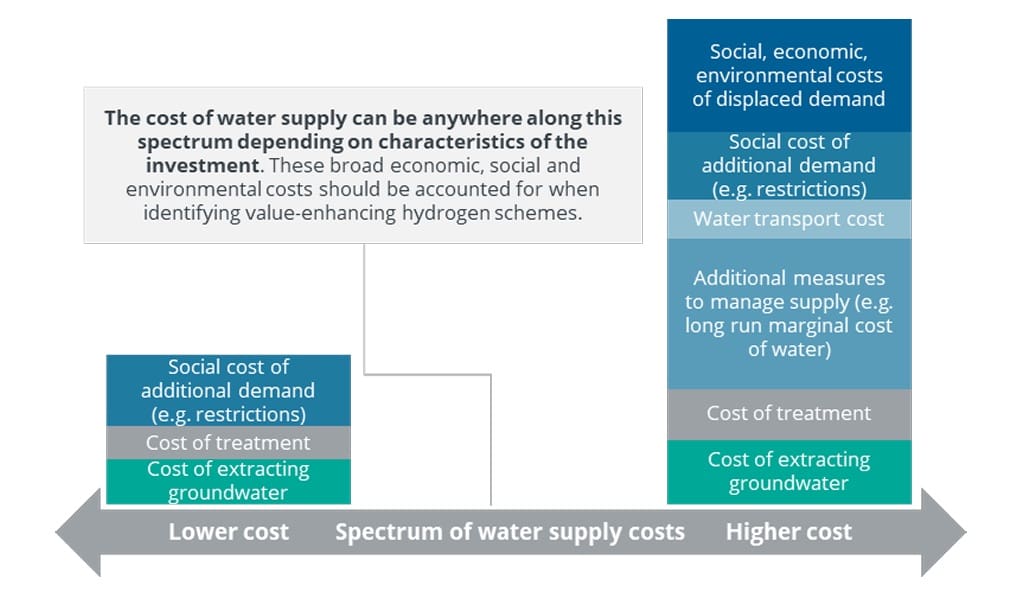

The costs of water supply are variable but in many places are already increasing

The challenges in providing water security in Australia are well known.

Australia has a highly variable climate and set of rainfall patterns. Changes to rainfall patterns, declining groundwater availability and changes to water allocation (in part related to increasing environmental considerations)—all increasingly exacerbated by climate change— are reducing the capacity of existing and primarily climate dependent systems to supply water to the community.

Alongside this, water demand particularly in many urban areas is expected to grow as result of population growth, increasing temperatures and evaporation rates and community expectations for irrigated ‘cool green’ communities.

For this reason, in many urban supply areas, water security is increasingly being met by climate independent sources of supply (such as desalination and recycling facilities) combined with water conservation and demand management. While often cost effective relative to investment in more traditional climate dependent sources (such as new dams), these measures are increasing water supply costs over time, reflected in higher water usage prices.[10] The era of low-cost water is over.

The National Hydrogen Strategy notes that other uses for water may have higher economic, social or cultural value.

However, the impact on availability of water and/or other users, will vary depending on site specific characteristics, such as the size of the hydrogen scheme, the supply and demand balance in the area and the other competing water uses.

In some cases, investment in a hydrogen scheme that displaces other water demand can deliver a net benefit to the community (i.e. where hydrogen displaces low-value demand).

Identifying and enabling investment in these value enhancing opportunities for hydrogen production requires identifying the range of economic, social and environmental costs and benefits of water supply.

In broad terms, in rural areas the cost will largely by the social and environmental costs of displacing current users. In metropolitan areas it could be the cost of measures to increase supply or where this is not possible, to manage demand.

Rural areas

Non-metropolitan areas are likely to be closer to the source of renewable energy and water supply, but further away from hydrogen demand (for example, export infrastructure).

In addition, while water licences can appear to be a relatively cheap source of water, without access to a high security access licence, water may not be available when it is needed.

In many rural regions, additional water supply options can be limited, which means that the cost of meeting the additional demand associated with the hydrogen scheme can be significant. Inland desalination can be prohibitively expensive, and many communities rely almost 100% on rainfall dependent water sources, which are becoming a less and less secure source of water.

In the instance where proponents can access a secure licence at a reasonable price, as most rural water systems are fully allocated, providing water to the hydrogen scheme is likely to displace current users, such as farmers and households.

This displacement of demand can generate a range of economic, social and environmental impacts and can present equity and socio-economic concerns, especially when the water is used to provide hydrogen for export to other countries.

Even in the instance where there are allocations available (the hydrogen scheme does not displace demand), at a minimum, the high reliability requirements of the hydrogen scheme would increase the risks and variability to other users.

This highlights the need for an economic model to help understand the socio-economic impacts of allocating water to a hydrogen scheme. This is similar to analysis that we undertook to help understand the impact of Basin Plan water recovery, that has significantly reduced water available to irrigators, industry and other water users, to improve environmental outcomes.[11]

Metropolitan areas

Alternatively, the hydrogen scheme could be located close to metropolitan areas, such as near Newcastle or Perth. This is likely to be located near the source of hydrogen demand (both domestic demand and export infrastructure for international demand) but can require transportation of the energy. It also presents unique water security challenges.

While connecting a hydrogen scheme to the existing water supply may seem like a simple solution (i.e. use what we already have), doing so will subject the plant to broader, complex water security rules, regulations and planning impacts, as a large customer in a bigger water supply system, which could have implications for secure hydrogen production (for example, hydrogen production may need to be subject to water restrictions).

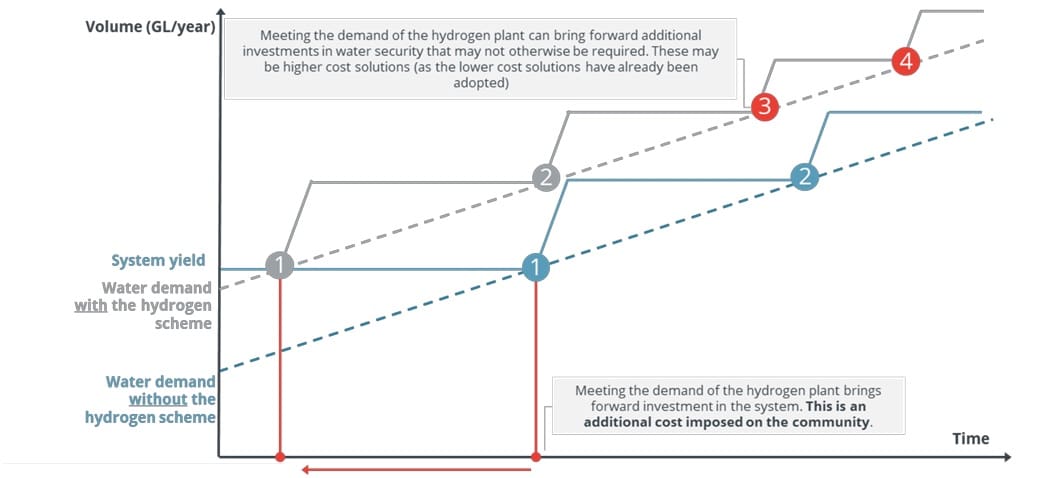

As shown in the graphic below, connecting the hydrogen scheme to the existing water supply, is likely to bring forward investment by a number of years, and/or trigger additional investment, in water supply or demand measures. These additional measures often represent more costly water supply options, as the lower cost options, such as surface and groundwater, have been fully utilised. This means that even in the presence of cost reflective prices, water prices are likely to increase in future.

While wastewater recycling or stormwater harvesting are also possible options, recycling is not a costless source of water because there are competing uses for it. For example, any recycling supplied to a hydrogen plant, is recycling that cannot be used to meet other non-potable, and increasingly, potable, needs.[12] In other words, using recycling to meet demand is not necessarily a low economic cost option.

An alternative option that is regularly raised is the construction of a desalination or wastewater recycling scheme to directly supply a new hydrogen scheme. However, like other major industrial customers, it may be the case that these hydrogen schemes remain connected to the water supply grid (to allow potable ‘top-up’).

Even if the hydrogen plant itself is not subject to water restrictions, restricting other users water supply while maintaining supply to the hydrogen plant can, as above, present equity and socio-economic concerns. For example, should a desalination plant built to service a hydrogen plant be required to service the broader community during periods of extreme drought?

In every case mentioned above, water security planning must be undertaken in a way to appropriately manage the, albeit uncertain, hydrogen demand.

Regardless of the water supply option adopted, supplying water for hydrogen schemes is likely to add the cost of building more water supply infrastructure on top of several other investments in water security, wastewater and stormwater management that are already planned over the next thirty years.

This highlights the need to holistically plan across the water cycle and across various (competing) water demands, to identify and enable investment where and when hydrogen delivers a net benefit to the community.

A sound economic framework is critical to supporting Australia’s hydrogen transition

However, in many planning processes to date, there has been limited consideration of:

- the additional water supply (or demand) measures that may be required to manage the potential for large but uncertain hydrogen related water requirements in addition to the existing supply and demand variables;

- the impacts on the cost of supply and prices paid by all water customers resulting from the need for increasingly costly measures to manage water security.[13]

This may be because:

- relative to other factors that drive grid supplied water demand, the hydrogen related component is either assumed to be small (as it could be directly supplied using purpose built desalinated seawater or wastewater facilities) or is highly uncertain and well off into the future – in terms of where and when it will occur, perhaps even at all.

- there are opportunities to increase the overall availability of water supply for the community, including recycling and desalination.

However, without proactive planning and engagement – supported by a sound economic framework– there is a risk that:

- a large-scale transition to hydrogen has the potential to exacerbate already competing demands for water resources (including wastewater and stormwater resources), particularly in regions that face significant water security challenges; and

- potentially value enhancing opportunities for hydrogen production are foregone as a result of continued water use for low value activities.

These examples highlight that while the cost of water may appear to be a small proportion of the cost of a hydrogen scheme, there is a need to consider the site-specific value of hydrogen schemes, including any implications across the water cycle early in the planning process. This requires planning and collaboration across the hydrogen, energy and water sectors underpinned by:

An economic framework for understanding the broader economic, social and environmental costs and benefits of meeting the broad range of water demands, including the opportunity cost of water supply options. While groundwater or wastewater resources may seem a low-cost solution to providing water for hydrogen in some areas, consideration should be given to the impact on competing users and the opportunity cost of alternatives uses of these resources.

If the water or wastewater resource could be used by other users, meeting the demand of hydrogen schemes will bring forward investment in the broader water supply system, imposing costs on the community.

- Planning that is adaptive and resilient under a range of risks and uncertainties. Depending on the location of hydrogen production some of supply costs may be incurred even if some of the hydrogen projects do not ultimately proceed, driven by the often large and lumpy investments required to provide water security. This suggests the need for decision-making to be aligned to adaptive planning processes, that is flexible to uncertainty, including climate change, uncertain demand and changing regulatory environments. Tools such as real options or adaptive pathways analysis enable decision-makers to understand the costs and benefits of resilient and adaptive decision making. This is similar to our analysis undertaken as part of the Lower Hunter Water Security Plan. [14]

- Getting pricing right ensure that efficient signals are provided regarding the cost of water supply and ensure water use occurs when and where the benefits outweigh the costs. The absence of cost reflective pricing across many jurisdictions in Australia means these signals are not being provided to many users. This requires robust estimates of the cost of providing water, including estimates of long-run marginal costs of water and wastewater.

While these steps are not always easy and require collaboration across sectors and disciplines across the public and private sector (including engineers, planners, scientists and economists), they provide a robust framework to better identify, quantify, value and incorporate these costs and benefits into decisions.

To download this publication in full (including references), click the button below.DOWNLOAD FULL PUBLICATION

Introduction

In September 1990, Scientific American published a special issue entitled ‘Energy for Planet Earth’. In this publication, Scientific American explored the sources of energy, the future for energy, made predictions on technological breakthroughs and suggested solutions for what they considered was an imminent energy crisis.

Many of these predictions by Scientific American were made for 2020. Given we have reached that date, we can look back and compare the predictions with what actually happened. In a three-part series, Frontier Economics compares actual outcomes to 2020 with the predictions made by Scientific American.

This comparison of actual versus predicted outcomes, especially where technological change is involved, can help us learn about the factors that have been determinative to the global community and provide guidance on how we can improve economic forecasts.

We focus on three areas where Scientific American made long term forecasts:

This is the third and final part of this series, examining the performance of Scientific American’s forecasts of emissions intensity.

Scientific American gets it right in Parts One and Two

In Part One - Energy demand we reviewed the performance of Scientific American’s long-term forecasts on primary energy demand. We found that, overall, Scientific American’s forecast was reasonably accurate. However, Scientific American did not perform as well on the growth performance by country. Most significantly, Scientific America materially underestimated the rapid and large increase in the growth of developing nations, such as China and India. That is, countries that were relatively poor in 1990 grew more quickly than expected, and they used energy to achieve this growth.

In Part Two - Energy intensity we reviewed the performance of Scientific American’s forecast of energy intensity. While Scientific American’s original historical depiction of energy intensity was stylised, it did accurately convey the historic profile of energy intensity – rising as countries develop, and then falling as economies mature. Given the size of the populations in developing countries in 1990, there was a genuine concern about the impact on energy demand (and resulting environmental problems) if these countries followed the same energy intensity profile as developed countries. However, Reddy and Goldemberg predicted that developing countries would benefit from improvements in materials science and energy efficiency innovations from developed nations. This technological transfer would avoid the high energy intensity peaks that occurred over the course of the previous 150 years of economic development of, now, developed economies. Reddy and Goldemberg were correct. The energy intensity of developing countries, while starting on the higher side of developed countries in 1990, quickly fell as they adopted the latest technologies. By 2015, developing countries had lower energy intensity than the developed countries originally analysed by Reddy and Goldemberg. In fact, by 2015, developing countries exceeded the most ambitious energy intensity decline forecast by Reddy and Goldemberg.

We conclude our three-part series by looking at Scientific America’s global projections for CO2 emissions from fossil fuels.

To view the full report, download the publication via the button below.DOWNLOAD FULL PUBLICATION

Introduction

In September 1990, Scientific American published a special issue entitled ‘Energy for Planet Earth’. In this publication, Scientific American explored the sources of energy, the future for energy, made predictions on technological breakthroughs and suggested solutions for what they considered was an imminent energy crisis.

Many of these predictions by Scientific American were made for 2020. Given we have reached that date, we can look back and compare the predictions with what actually happened. In a three-part series, Frontier Economics will compare actual outcomes to 2020 with the predictions made by Scientific American.

This comparison of actual versus predicted outcomes, especially where technological change is involved, can help us learn about the factors that have been determinative to the global community and provide guidance on how we can improve economic forecasts.

We focus on three areas where Scientific American made long term forecasts:

- Primary energy demand (Part One)

- Energy intensity (this article)

- Emissions intensity (Part Three forthcoming).

Each of these is the subject of a separate note. This note examines the performance of Scientific American’s forecasts of energy intensity.

Scientific American gets it right in Part One

In Part One we reviewed the performance of Scientific American’s long-term forecasts on primary Energy Demand. We found that, overall, Scientific American’s forecast was reasonably accurate. However, Scientific American did not perform as well on the growth performance by country. Most significantly, Scientific America materially underestimated the rapid and large increase in the growth of developing nations, such as China and India. That is, countries that were relatively poor in 1990 grew more quickly than expected, and they used energy to achieve this growth.

In this second part of our three-part series, we assess the performance of Scientific American’s forecast of energy intensity.

To view the full report, download the publication via the button below.

DOWNLOAD FULL PUBLICATION

The Australian Gas Industry Trust (AGIT) and Jemena have published a study undertaken by Frontier Economics on The role of gas in the transition to net-zero power generation. Our study was commissioned by AGIT and Jemena to understand the changing role that gas generation plays in today’s electricity markets, and how that role will continue to evolve as electricity markets transition to net-zero emissions.

Our study found that the requirement for flexible generation will continue to increase as the penetration of intermittent renewable generation increases and that gas generation will have an important ongoing role to play. These findings are consistent with what we observe in electricity markets around the world, including markets with a bigger share of intermittent renewable generation than Australia. In these markets, gas generation continues to play an important role by providing generation capacity that is both firm and flexible.

The property sector has been exploring the ways that climate change could affect business, and until now, this has mostly been focused on the physical effects. However, it is important that businesses don't overlook transition risks as they start to deal with the move to a low carbon economy. There is growing industry level discussion about the potential material financial impacts of this transition for the property sector. We see three key issues as important for those businesses navigating their way through this challenge.

These are:

- The implications of leasing verses owning buildings regarding emissions scope

- The role of target setting

- How to factor in shadow carbon pricing

Frontier Economics and Edge Environment have partnered to provide comprehensive sustainability and economic advice to guide businesses through climate change risk and reporting. A new article, co-authored by Ben Mason from Frontier Economics, along with Mark Siebentritt, Miranda Siu and Jackie McKeon from Edge Environment, discusses the challenges that the property sector face navigating this complex area.

To read the full article, click below:

DOWNLOAD FULL PUBLICATION

A closer look at the burning question

Thermal waste-to-energy involves converting residual waste into electricity, typically through direct combustion or high temperature gasification. It promises to put rubbish to good use – reducing greenhouse gas emissions by diverting waste from landfill and offsetting electricity generation from the grid. However the reality is not that simple.

The analysis of thermal waste-to-energy emissions is often assumption driven, and fails to accurately account for extensive energy capture at modern landfills and major changes already underway in the waste and electricity sectors. Well intentioned policy, supported by inaccurate analysis, risks unneccesarily locking in high emissions in the waste sector for decades to come.

In this bulletin, we explore the drivers of waste to energy emissions and consider how the trade offs between landfill energy and thermal waste-to-energy will likely change over the next ten years.

To download this publication, click the button below.

DOWNLOAD FULL PUBLICATION

Thermal waste‑to‑energy is the process of converting rubbish into electricity, typically through direct combustion. It promises to reduce emissions by killing two birds with one stone – diverting waste from landfill and offsetting high emissions electricity generated in the grid.

Several large waste‑to‑energy projects have been supported recently, partially based on their promised emissions reductions.

Unfortunately, it isn’t that simple. Frontier Economics recently investigated the potential emissions from thermal waste‑to‑energy, looking closely at two recently approved projects in Western Australia and Victoria. We found that the analysis of thermal waste‑to‑energy emissions often depends on three faulty assumptions:

- That waste‑to‑energy will forever offset electricity produced by the highest emissions alternative – either black or brown coal

- That the alternative to thermal waste‑to‑energy is to dispose waste in a landfill with poor gas capture and zero energy recovery

- That the composition of waste won’t change over time, despite plans for widespread introduction of green waste diversion.

These assumptions aren’t true today, and will become even less accurate over time.

We found that thermal waste-to-energy risks locking in unnecessarily high emissions for the long‑term despite changes in the electricity and waste sectors that should make emissions reductions possible. Well intentioned policy, supported by faulty analysis, can easily lead to poor environmental outcomes.

For an overview and to see the key findings, read our bulletin: Emissions from landfill and thermal waste-to-energy.

Read the full report: Assessing emissions from waste to energy.

Storing energy generated by solar and wind into batteries is not the only option available to address issues of reliable supply. Other forms of storage can more economically hold greater quantities of potential electricity than batteries. Hydrogen is one of these options, and it provides real promise.

Produced using an electrolyser with no emissions (green hydrogen), when burned the hydrogen produces only electricity and water. The technology to produce green hydrogen already exists, but does not operate at large scale. The challenge is not making hydrogen, but it economic. Electrolysers use a lot of energy to make hydrogen. If there is a large enough difference between the costs of buying green electricity to make hydrogen and the price at which hydrogen produced power is sold, then it can be done economically. This is possible in a system like South Australia where there is so much green power being supplied through the day that prices are now often negative – that is, an electrolyser actually gets paid to take power. At night, power prices rise because more expensive (but more reliable) generators switch on to meet demand. That’s when hydrogen generators cover the costs of producing the hydrogen and making green electricity.

Frontier Economics helped SA Labor design a world first large scale (250 MWe) electrolyser paired with a highly flexible gas generator (200 MW). The electrolyser would have a big enough load to help stabilise the grid in the middle of the day when there is surplus electricity and the generator is big enough to make a difference to prices at peak demand times when there is no solar generation. Government backing of this world first large scale plant combination will, like the Tesla Big Battery, propel the development of this technology. Frontier Economics’ modelling showed that this plant would reduce the wholesale electricity price in SA by 8%.