The Copyright Tribunal of Singapore today released its decision in SingNet v COMPASS.

SingNet is an ISP subsidiary of SingTel. The Composers and Authors Society of Singapore (COMPASS) had been negotiating with SingNet over the cost of the licence SingNet needed to broadcast music. SingNet brought proceedings claiming that the licence fee requested by COMPASS was unreasonable. Frontier Economics was retained by lawyers for COMPASS to provide advice and to give evidence at the hearing. The Tribunal dismissed SingNet’s claim.

Frontier Economics advises clients on a range of intellectual property valuation and dispute support matters.

The Australian Competition and Consumer Commission (ACCC) announced today that it will not oppose Cleanaway’s proposed acquisition of two landfills and five transfer stations in Sydney from Suez. The ACCC was concerned about the effects on competition for the transport and processing of putrescible waste (that is, waste that contains putrescible organics, such as food waste). Frontier Economics was retained by lawyers for Cleanaway to undertake an empirical analysis of the geographic markets in which transfer stations competed.

Frontier Economics advises clients on a range of competition and dispute support matters.

The National Australia Bank Limited (NAB) sought to acquire the Australian consumer business of Citigroup Australia Pty Limited (Citi). They applied for informal clearance of the proposed acquisition from the ACCC. The ACCC’s investigation focused in particular on the white-label business of Citi and whether NAB would have an incentive post-acquisition to damage this business which competed with its own-label cards.

Frontier Economics was retained by lawyers of the parties to assess these incentives and write a report which was submitted to the ACCC. The ACCC announced today that it would not oppose the acquisition.

Frontier Economics advises clients on a range of competition and dispute support matters.

The New Zealand Competition Commission (NZCC) today published a study undertaken by Frontier Economics. Our study is entitled Economic analysis of the New Zealand Retail Grocery Sector. The study was commissioned by the NZCC as an input into its market study of the New Zealand Retail Grocery Sector.

The econometric analysis consisted of two parts. The first was a cross-sectional study examining the extent to which differences in concentration in local grocery markets is associated with differences in prices charged by the supermarkets. The second was a time-series study examining the extent to which entry, exit and rebranding in local grocery markets is associated with changes in prices charged by the incumbent supermarkets.

The NZCC is seeking submissions on its draft report Market study into the retail grocery sector.

Frontier Economics undertakes econometric analysis across a range of markets for our clients.

On 6 May 2020, the Full Court of the Federal Court dismissed the appeal by the Australian Competition and Consumer Commission (ACCC) against Aurizon Holdings Limited (Aurizon) and Pacific National Pty Ltd (Pacific National).

On 14 August 2017, Aurizon announced its intention to exit its intermodal business by selling various assets to Pacific National. The ACCC opposed the sale and, as a result, some of the proposed arrangements were changed. However, the sale of the Acacia Ridge rail terminal remained a major issue. The dispute went to trial before the Federal Court where the judge found that the sale would have been illegal but for an undertaking for access to the terminal that the Pacific National produced towards the end of the trial.

The ACCC appealed this decision to the Full Court of the Federal Court. The Full Court dismissed the appeal. It found that that there was no need for the undertaking as a constraint, because barriers to entry were so high that entry in the future without the acquisition was no more than a ‘mere possibility.’ Frontier Economics advised the ACCC in their case prior to the trial and Philip Williams gave expert testimony at the trial.

Frontier Economics advises clients globally on transport and competition matters.

The Australian Competition and Consumer Commission (ACCC) announced today that it would not act to prevent the acquisition of Pacific Magazines by Bauer Media. Over the last decade, all magazine titles have been losing circulation to online sources. Pacific Magazines was one business Seven West Media wished to sell.

The ACCC acknowledged the constraint imposed by online sources; nevertheless it was concerned that the acquisition would place two pairs of magazines in the same hands: Woman's Day and New Idea, and Take 5 and That's Life!. Frontier Economics was retained by lawyers for both Bauer Media and Pacific Magazines to undertake detailed empirical analysis of scan data to test in various ways the degree of substitution within each of these pairs of magazines. Our work found that the scan data over recent years did not reveal a high degree of competition within each of these pairs of magazines.

Frontier Economics regularly advises clients on competition matters involving the use of quantitative analysis.

The Federal Court recently released the judgement in the TPG – Vodafone merger case and the Australian Competition and Consumer Commission has announced it will not appeal the decision. Three of the Frontier Economics team acted as expert witnesses in the case: two from Frontier Economics in Australia and one from Frontier Economics in London, with further support from other Frontier economists and econometricians.

Professor Stephen Gray gave evidence regarding TPG’s ability to access the equity capital markets. In particular, he provided evidence about how investors would be likely to view the risk of investing a capital raising and whether a capital raising could be executed. Justice Middleton accepted Professor Gray’s evidence about the likelihood of a capital raising (see paragraphs 462-466).

David Foster, from Frontier Economics in London, gave evidence about the extent of competition in a counterfactual world in which TPG does enter, and its relative competitiveness to the factual in which the merger occurs (see paragraph 482). While detail about this evidence was heavily redacted in the public version of Middleton J’s judgement, it accepted Foster’s evidence that there is a “real prospect” that the market is reduced to “2.5 operators” (see paragraph 483).

Warwick Davis provided an expert report to TPG but was not called upon to give evidence in court. His expert report covered 5G network modelling.

Middleton J pointed out in the opening paragraphs in his judgment that the “only question for this Court is whether the merger would have the effect, or be likely to have the effect, of substantially lessening competition in the supply of retail mobile services in Australia”. Ultimately, he was not satisfied that the ACCC’s argument that TPG would roll out a mobile network should it not merge with Vodafone, and then would become a viable competitor to the three players: Telstra, Optus and Vodafone, was correct. Rather, the judge decided that the merger of TPG and Vodafone would in fact create a stronger competitor for the two remaining mobile operators. This view was borne out in the initial market reaction to the news, as put forward by Warwick Davis and James Key.

Frontier Economics advises clients globally on telecommunications and competition matters.

For more information, contact us.

The Australian offices of Frontier Economics will be closed from 5pm Monday 24 December 2018 and will re-open at 9am on Wednesday 2 January 2019.

The Singapore office of Frontier Economics will be closed for the public holidays of Tuesday 25 December 2018 and Tuesday 1 January 2019.

We wish you all a Merry Christmas and hope you enjoy the festivities of the holiday season.

For more information, please contact:

Contact Us

The Singapore office of Frontier Economics has moved. Our new office offers us greater flexibility for growth and additional features to support our work.

“Frontier’s presence in Singapore continues to expand and we are excited to have worked with many new clients as well as longstanding clients on new matters and in new jurisdictions across the Asia-Pacific region. Our new office will provide a larger platform to support our continued growth in Singapore and beyond” says Frontier (Asia-Pacific) director James Allan.

From our base in Singapore, Frontier Economics is fully committed to providing independent, high quality economic advice across the region.

Frontier Economics can now be found at:

60 Anson Road

Level 17, WeWork

Singapore 079914

Tel: +65 9450 5627

For more information, please contact:

Contact Us

Recent ACCC wholesale reports shed light on the impact of recent price changes

As NBN Co (nbn) continues to refine pricing of the various products it offers, we examine the early impact of a price change that took place 14 December 2017.

The change had two key components.

The first was to lower the cost of a 50mbps download, 20mbps upload (50/20) connection to that of a 25/5 connection.

The second was to provider retailer service providers (RSPs) with a free 50% increase in shared bandwidth capacity (CVC) as part of a transition to new pricing models.

Impact on plan speeds

One of the criticisms of Australia’s fixed broadband network was the low take up of high speed connections, leading to headlines comparing Australia to Kazakhstan.[1] With 50% of nbn customers previously on 25/5 plans[2], shifting the customers to 50/20 plans by equating the connection fees could improve things. As expected, RSPs migrated plans, with TPG replacing the 25/5 plan with the 50/20 plan where available. Telstra, meanwhile, made the 50/20 plan a free upgrade to eligible customers or removed the 25/5 option.[3] As can be seen in Table 1, there has been a very modest uptake of the 50Mbps plan, with no impact on the average maximum speed of nbn connections. This is perhaps not surprising, given the limited time since the price change.

Table 1: Speed composition of nbn connections

| Tier |

2016Q1 |

2016Q2 |

2016Q3 |

2016Q4 |

2017Q1 |

2017Q2 |

2017Q3 |

2017Q4 |

| 12 |

32.7% |

32.1% |

31.7% |

30.8% |

29.6% |

29.4% |

30.1% |

30.2% |

| 25 |

48.1% |

50.2% |

51.9% |

52.0% |

53.0% |

53.5% |

53.1% |

52.6% |

| 50 |

4.4% |

3.9% |

3.6% |

3.7% |

3.7% |

4.0% |

3.9% |

4.5% |

| 100 |

14.8% |

13.8% |

12.8% |

13.6% |

13.7% |

13.2% |

12.9% |

12.7% |

| Average Mbps |

33.0 |

32.2 |

31.4 |

32.1 |

32.3 |

32.1 |

31.8 |

31.8 |

Source: ACCC NBN Wholesale Market Indicators Reports

Impact on CVC capacity acquired

Key to the experience of an ultrafast broadband connection is actually being able to download at the speeds the connection is capable. However, there may be congestion if RSPs have not purchased sufficient CVC capacity from NBN Co; RSPs have claimed that the CVC price is too high to ensure good performance. This may noticeably slow down connections during peak hours, known as the ‘Netflix effect’.

Successive price discounting models failed to generate much of a reaction, with average CVC capacity purchased per user barely budging over last two years. However, the December 2017 change was substantial in magnitude, offering 50% extra for free.[4]

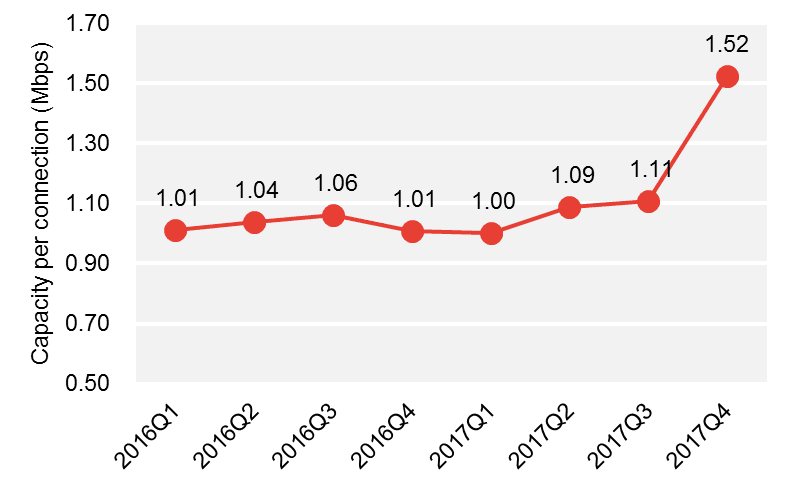

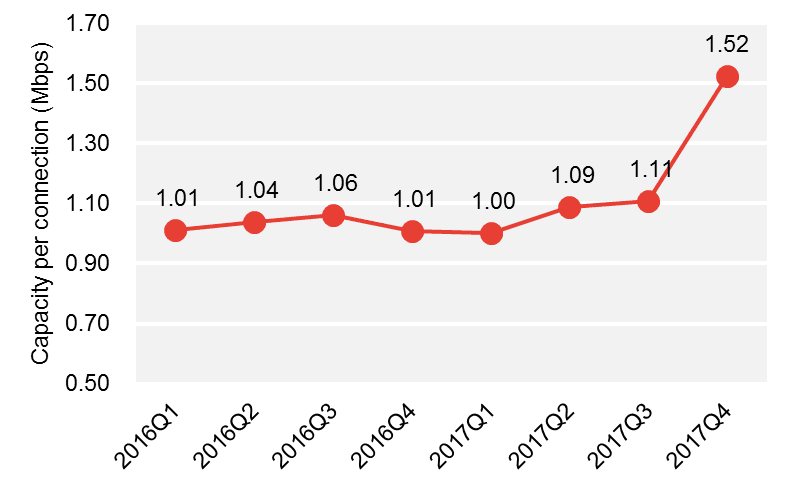

The initial results of this can be readily observed. While the increase in 2017Q3, from 1.09 to 1.11 Mbps was described as “encouraging”,[5] the increase shown below should leave Rod Sims ecstatic. The 38% increase in capacity per connection should meaningfully impact customer experience.

Figure 1: CVC capacity

Source: ACCC NBN Wholesale Market Indicators Reports

Only time will tell whether this is the start of a trend towards increasing purchases of bandwidth, or a one off blip driven by a “freebie” for RSPs. Needless to say, it is a rare bit of good news for nbn.

Conclusion

We have been concerned that CVC prices have been neutralising the NBN’s key competitive advantage: the ability to send large amounts of data through its network at very low (near zero) cost. Only substantial and long-lasting changes to CVC pricing will allow the NBN to withstand inevitable competitive pressure from mobile broadband. With NBN Co recognizing the threat[6], and introducing new pricing models, we have seen perhaps the first ever improvement in NBN congestion during peak hours.

[1] See http://www.smh.com.au/business/consumer-affairs/australia-s-broadband-slower-than-kazakhstan-20180107-p4yyb1.html

[2] This connection is limited to 25Mbps download, 5Mbps upload.

[3] Retaining 25/5 for 100GB limit plans.

[4] Not quite the same as a 33% discount: under the pricing model the price faced by an RSP depends on CVC quantity bought during the previous Billing period.

[5] https://www.accc.gov.au/media-release/accc-releases-quarterly-report-on-the-nbn-wholesale-market-4

[6] “Wireless broadband will be a legitimate alternative to fixed broadband in the 2020s for some applications – more than we may have assumed say five years ago,” – NBN chairman Dr Ziggy Switkowski, CommsDay Congress, October 2017.